Auto Loans

Your loan. Your budget.

Find the rate, term, and monthly payment that works for you.

Questions? Let’s talk.

Benefits for you

Our Auto Loan benefits

Competitive rates

Today’s Auto Loan rates

Competitive rates

Today’s Auto Loan rates

| Model Year | Term | APR1 As Low As | Monthly Payment |

|---|---|---|---|

| 2022 or newer | 24 months | 6.99% | $671.52 |

| 36 months | 6.19% | $457.62 | |

| 48 months | 6.39% | $354.96 | |

| 60 months | 6.50% | $293.49 | |

| 72 months | 6.89% | $254.94 | |

| 84 months | 7.69% | $231.48 | |

| 2021 and older2 | 24 months | 6.29% | $666.77 |

| 36 months | 6.44% | $459.33 | |

| 48 months | 6.69% | $357.04 | |

| 60 months | 6.94% | $296.59 | |

| 72 months | 7.49% | $259.28 | |

| 84 months | 8.24% | $235.59 | |

| Accurate as of 09/16/2025 | |||

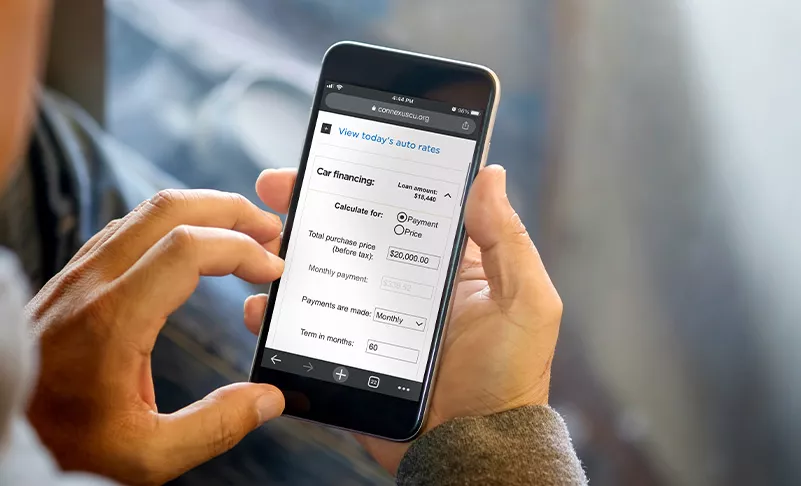

Calculator

- Calculate Auto Loan payment Find out how much vehicle you can afford and your monthly Auto Loan payment with our easy-to-use calculator.

simple financing steps

Auto Loan process

available coverage

Protect your vehicle

Choose comprehensive coverage options, such as Debt Protection, GAP Protection, and our Warranty Program, to safeguard your investment and give yourself peace of mind for the road ahead.

blog

Learn more about car buying

Auto Loan Pre-Qualification and Pre-Approval: What’s The Difference?

Gearing up for a new ride? Learn the difference between being pre-qualified and pre-approved for an Auto Loan.

10 Common Mistakes Car Buyers Make

Buying a new vehicle is exciting, but it’s easy to overpay if the excitement clouds your judgment. Here are ten common mistakes car buyers make and tips to help avoid them.

Why Get Financing BEFORE You Buy a Vehicle

If you want your dealership experience to be as smooth as possible, get your financing first. Here’s why.