Welcome to Connexus Credit Union

We’re excited to welcome you as a new member-owner of our credit union! This page is designed to provide you with all the important information you need to get started with Connexus, including an explanation of how you became a member, how to access your account, and how to set up payments.

How you became a Connexus member

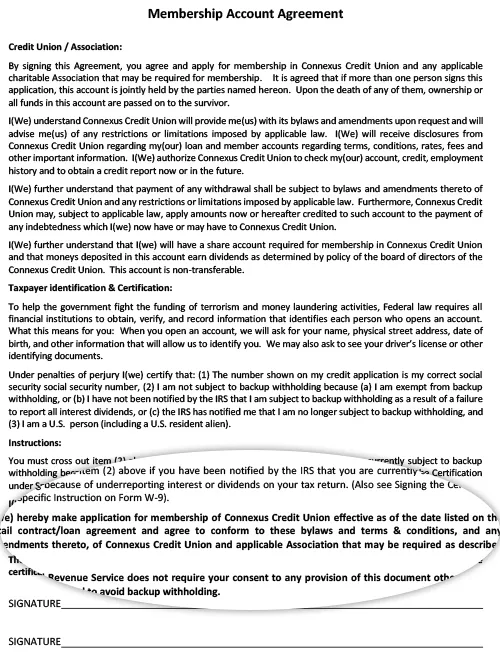

You agreed to become a member of Connexus so we could help finance your recent purchase. Within your financing agreement, you authorized both the assignment of your loan to Connexus and the application of your membership.

To become a member of any credit union, you must have a savings account. Since credit unions are owned by their members, this account represents your ownership in Connexus Credit Union.

You will notice your new Member Share Savings Account currently has a balance of $5. That $5 was deposited on your behalf to help you get started as a Connexus Credit Union member.

Your next steps as a member

You will soon receive a letter in the mail that includes your member number and account details. Until then, you can set up loan payments with Concord using your 11-digit account number found on your loan statement.

Though your loan was purchased by Connexus, your loan payments will be made to Concord. View your payment options to get started.

“Need help? Don’t hesitate to contact us. Our team is ready to answer all of your questions.”

Cheryl Schoessow,

Vice President of Member Contact Center